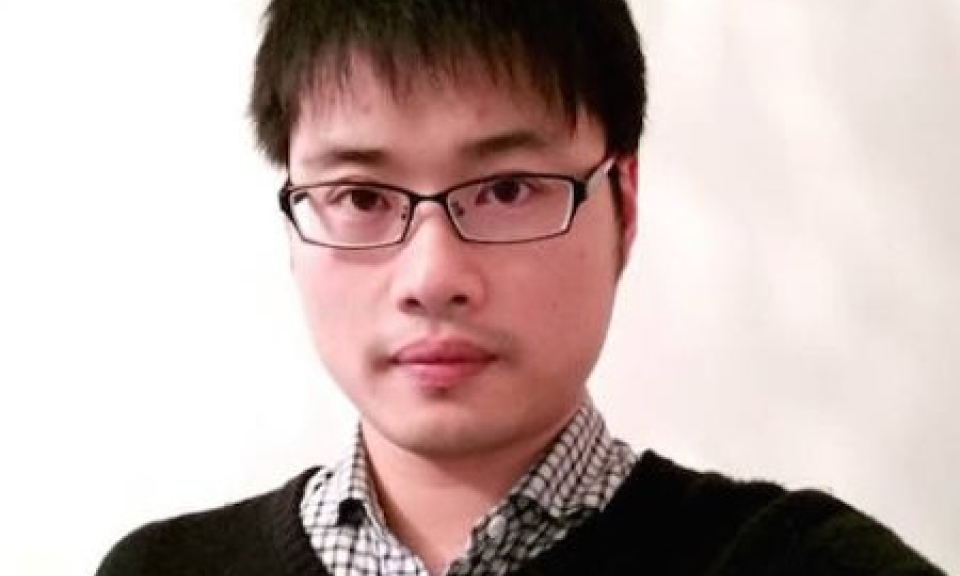

Recent alum Dr Yu Zheng has already put his Quantitative Finance PhD to good use by launching a FinTech start-up, Arraystream Technologies. The business aims to help fund-providers launch the next generation of mutual funds, powered by AI. The technology utilises a proprietary signal construction technique which generates composite signals to help identify new opportunities in the investment space, while remaining adaptable to new market information. Another core technology is ‘polymorphic diversification’, which adds a new dimension of diversification. Polymorphic diversification both augments and enhances existing diversification techniques such as sector, asset class and region.

The technology is complex and clever and so it’s no wonder the business was recently backed by Entrepreneur First – which funds the most talented scientists, engineers, developers and industry experts to grow their businesses and raise funds. Yu was invited to share his vision with world’s leading investors and press at the Entrepreneur First London Demo Day in March 2018.

What gave you the idea for your business?

It is widely known that over 90% actual mutual funds have been underperforming the index in the last 15 year. The industry has been trying to come up with many solutions, but not a lot have worked.

"My PhD research into applying machines learning to financial data led me to the idea of AI-powered mutual funds. We are creating the next generation of mutual funds, powered by AI. This approach has never been done before."

How did it feel when your business launched?

It was both exhilarating and exhausting. Exhilarating because I have launched a company on the world stage and I was excited to contribute something valuable. Exhausting because in the initial stage I was doing multiple roles at the same time: CEO, salesman, researcher, developer, operations and support.

What was the greatest challenge you faced in starting out?

The greatest challenge was validating our start-up idea. A number of questions had to be answered, such as is the problem worth solving, does anyone care about this, is there a market at all, and how to convince customers that our technology works etc. It was necessary to construct a US stock portfolio using our technology which we ran with real money. Over the period of a year our portfolio has demonstrated fairly consistent performance advantages over the S&P 500.

What have been the key lessons learned from the whole process?

You have to be flexible to adapt to the market needs, but you must also have conviction when starting out amidst a sea of uncertainty.

Any advice to budding entrepreneurs?

The best ideas are outside of your room/office, so go out and talk to potential customers.

How did your time at the Business School prepare you for setting up your own business?

The Business School offered me a comprehensive research training and gave me insights into the real, business-side of the financial industry. Furthermore, it also provided me the invaluable people network for which I can tap into to grow my business.