Paying for UK Net Zero: principles for a cost-effective and fair transition

Topics: Economics and Finance

Type: Briefing paper

Publication date: March 2021

Download

Summary

Authors: Dr Richard Carmichael, Krista Halttunen, Sofia Palazzo Corner and Dr Aidan Rhodes

This briefing note explains why the UK government needs to take a joined-up approach to decarbonising the economy and considers the broad range of measures that must be taken by Her Majesty’s Treasury in order to enable the behaviour changes needed to transition to net zero.

Headlines

-

The Treasury’s consideration of spending should embrace a broad range of measures to enable behaviour change for Net Zero including, but not limited to, fiscal policy. Supporting behaviour change should aim to lower financial, information and social barriers in a fair and consistent manner and could take advantage of better use of data and digital tools.

-

Principles for decision-making should recognise the value of fostering positive feedback effects that build momentum in behavioural shifts and in system-wide change, for example by supporting the emergence of new social norms, innovation and early adopters and leveraging co-benefits.

-

The Treasury has a role to play in supporting the development of a healthy and sustainable private sector investment community. There are several tested options for assisting with access to finance that the Treasury could consider in its review, such as revolving funds, devolving funds to the local level, government-backed loans and the recently-announced National Infrastructure Bank.

-

The UK government needs to take a joined-up approach to decarbonising the economy. It is inefficient and wasteful of public funds to stimulate decarbonisation with some funds while stimulating the creation of greenhouse gases with others. The UK public also want to see a comprehensive and consistent plan. Therefore, subsidies to fossil fuels should be wound down.

-

It is also important for the Treasury to actively consider and promote principles and policies that can support trade that protects against emissions offshoring – shifting sources of emissions to other countries; this may include a transparently and carefully designed border carbon adjustment (BCA).

-

There is likely to be a need to invest public money in low-carbon, resilient infrastructure, and to demonstrate a transparent balance between tax and spend, which will decline over time as revenues from fossil fuel taxation decline. This balance sheet approach could improve public acceptance of taxes to tackle climate change, with or without a restrictive hypothecation approach.

Download: Paying for UK Net Zero: principles for a cost-effective and fair transition [PDF]

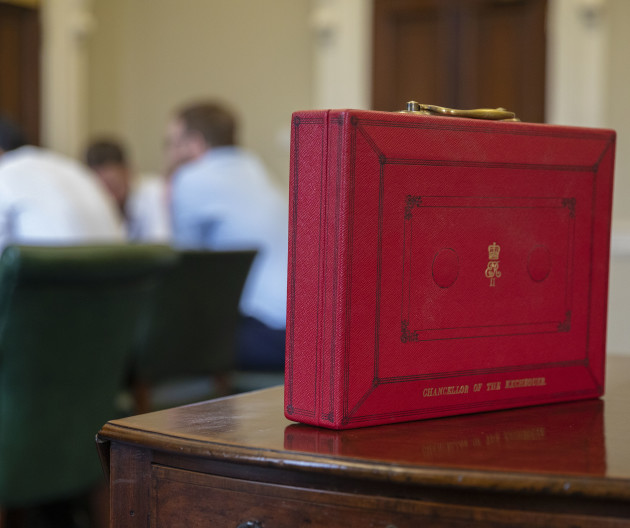

[Image: Chancellor of the Exchequer (c) HM Treasury | CC BY-NC-ND 2.0]