Core modules

Core Modules

Computing for Finance - Computing in C++ (P. Bilokon)

The course gives an introduction to object oriented programming in C++. In contrast to structured programming, where a programming task is simply split into smaller parts, which are then coded separately, the essence of object oriented programming is to decompose a problem into related subgroups, where each subgroup is self-contained and contains its own instructions as well as the data that relates to it. Starting from the simple concept of a class that contains both data and methods relating to that data, the course will cover all the major features of object oriented programming, e.g. encapsulation, inheritance and polymorphism. To this end, the course will address operator overloading, virtual functions and templates.

The course gives an introduction to object oriented programming in C++. In contrast to structured programming, where a programming task is simply split into smaller parts, which are then coded separately, the essence of object oriented programming is to decompose a problem into related subgroups, where each subgroup is self-contained and contains its own instructions as well as the data that relates to it. Starting from the simple concept of a class that contains both data and methods relating to that data, the course will cover all the major features of object oriented programming, e.g. encapsulation, inheritance and polymorphism. To this end, the course will address operator overloading, virtual functions and templates.

- Course tutor: Dr Paul Bilokon

Computing for Finance- Python (A. Muguruza)

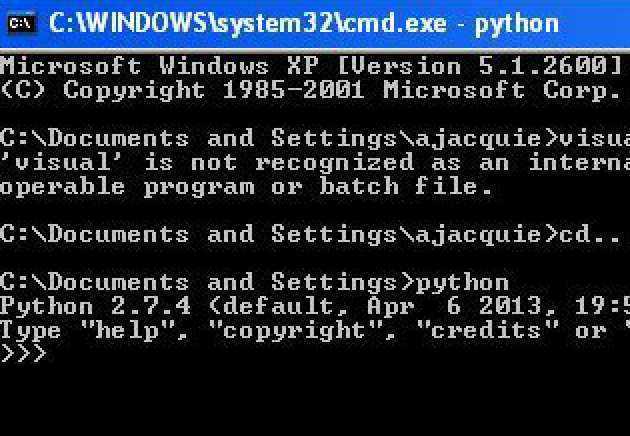

This module is part of Computing in Finance and will give an introduction to the Python programming language. Attending this course is a prerequisite to Computig in Finance - C++

This module is part of Computing in Finance and will give an introduction to the Python programming language. Attending this course is a prerequisite to Computig in Finance - C++

Python has become a key programming language today, due to its versatility, open source nature and wide range of capabilities, from big data management to numerical analysis and visualisation tools. In and in banks. Python is now a fundamental tool to quantitative analysis, and a pre-requisite for job applications. The goal of this module is to introduce the key concepts of the Python programming language and its main characteristics, in particular:

- Programming features: Functional Programming to Object-oriented programming

- Big data analysis: Pandas, Dask,…

- Statistical tools and libraries

- Web-scraping

- Visualisation tools

All these concepts will be illustrated with real data and in the context of Quantitative Finance.

- Course tutor: Dr Jack Jacquier

Fundamentals of Option Pricing Theory (P. Siorpaes)

This course is an introduction to option pricing theory, a core area of Mathematical Finance, and its mathematical and conceptual underpinnings. The goal is to familiarize students with the tools and methods of continuous-time arbitrage pricing theory, in the setting of the Black-Scholes model. Probabilistic tools - Brownian motion, the Ito integral, stochastic calculus- will be introduced in a self-contained manner and further explored in the Stochastic Processes course (see below).

This course is an introduction to option pricing theory, a core area of Mathematical Finance, and its mathematical and conceptual underpinnings. The goal is to familiarize students with the tools and methods of continuous-time arbitrage pricing theory, in the setting of the Black-Scholes model. Probabilistic tools - Brownian motion, the Ito integral, stochastic calculus- will be introduced in a self-contained manner and further explored in the Stochastic Processes course (see below).

We will cover both financial and mathematical concepts, such as:

- Financial markets, forwards, options and financial derivatives

- Self-financing portfolios and non-anticipative strategies

- Absence of arbitrage, the domination property and law of one price

- Complete and incomplete markets, pricing by replication

- Change of measure and the Radon-Nikodym theorem

- Linear programming, equivalent martingale measures, the fundamental theorems of asset pricing, the risk-neutral pricing formula

- Change of numeraire

- Conditional expectation: definition, properties, and computation

- Martingales and Markov processes

- Brownian motion and the Black-Scholes model as continuous-time limits of scaled random walks

- Why Riemann integration and ordinary calculus do not apply to Brownian motion

- The stochastic integral, semimartingales and their canonical decomposition, quadratic variation, Ito's formula

- Hedging derivatives in the Black-Scholes model, delta-hedging

- The Black-Scholes PDE (Partial Differential Equation), the heat equation, and the Feynman-Kac formula

- Girsanov’s theorem, the martingale representation theorem, Levy’s characterisation of Brownian motion

- Black-Scholes pricing formula for call and put options, the Greeks Absence of arbitrage, the domination property and law of one price

- Course tutor: Dr P. Siorpaes

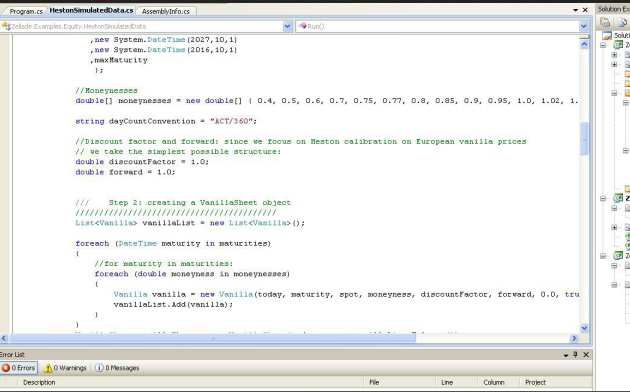

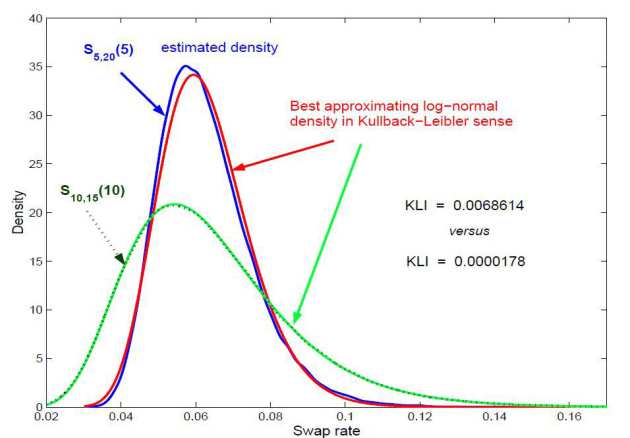

Interest Rate Models with Credit Risk, Collateral, Funding Liquidity Risk and Multiple Curves (D. Brigo)

This is a course that deals with the theory and practice of the term structure of interest rates when including also credit risk, funding liquidity costs, collateral modeling and multiple curves. The paradigm of derivatives valuation is shifting from complex payouts designed on simple single asset class risks to simple products that are now managed by analyzing previously neglected complex and interconnected nonlinear risks. The course starts by briefly putting derivatives valuation into context, in connection also with the onset of the 2007-2008 crisis that prompted many of the changes we are seeing now. The course then moves to classic interest rate models based on a risk free rate, on classical instantaneous forward rates, and on default free LIBOR and SWAP rates, also in presence of volatility smile. Several families of models are introduced and studied in detail, with an eye both to a rigorous theoretical derivation and to practical implementation and calibration. Following the classical part, the increasingly important issues of multiple discount curves, credit risk, credit and debit valuation adjustments, collateral modeling, gap risk and funding liquidity costs are analyzed quantitatively. The related notions of CVA, DVA and FVA are analyzed and criticized in detail, and their significance for the general derivatives valuation paradigm is discussed. The specific case of trading through central clearing (CCPs) is hinted at. Finally, an analysis of Risk measures for interest rate derivatives products is presented, with a case study highlighting the role of correlation and dependence in Risk measurement.

This is a course that deals with the theory and practice of the term structure of interest rates when including also credit risk, funding liquidity costs, collateral modeling and multiple curves. The paradigm of derivatives valuation is shifting from complex payouts designed on simple single asset class risks to simple products that are now managed by analyzing previously neglected complex and interconnected nonlinear risks. The course starts by briefly putting derivatives valuation into context, in connection also with the onset of the 2007-2008 crisis that prompted many of the changes we are seeing now. The course then moves to classic interest rate models based on a risk free rate, on classical instantaneous forward rates, and on default free LIBOR and SWAP rates, also in presence of volatility smile. Several families of models are introduced and studied in detail, with an eye both to a rigorous theoretical derivation and to practical implementation and calibration. Following the classical part, the increasingly important issues of multiple discount curves, credit risk, credit and debit valuation adjustments, collateral modeling, gap risk and funding liquidity costs are analyzed quantitatively. The related notions of CVA, DVA and FVA are analyzed and criticized in detail, and their significance for the general derivatives valuation paradigm is discussed. The specific case of trading through central clearing (CCPs) is hinted at. Finally, an analysis of Risk measures for interest rate derivatives products is presented, with a case study highlighting the role of correlation and dependence in Risk measurement.

- Course tutor: Professor Damiano Brigo

Quantitative Risk Management (L. Gonon)

After the financial crisis of 2007-2008, in particular, it has been understood how important proper risk management is for the solvency of financial institutions and for the stability of the entire financial system. This course introduces the key concepts and methods of quantitative risk management, with an emphasis on market risk and volatility. We endeavour to cover the following topics:

- Risk management and stylised facts: taxonomy of risks, the regulatory framework, overview of quantitative risk management, stylised facts of asset returns.

- Basic concepts of risk management: risk factors, loss distributions, risk measures (including value-at-risk and expected shortfall), historical simulation, Monte Carlo simulation, backtesting.

- Univariate time series modelling: ARMA and GARCH models, estimation and forecasting, applications to risk measures.

- Heavy-tailed distributions and extreme value theory: characterisations of heavy-tailed distributions and examples, the distribution of maxima, modelling of threshold exceedances, applications to risk measures.

- Multivariate time series and covariance modelling: multivariate time series models, multivariate GARCH models, applications to equity portfolio risk.

- Copulas and dependence modelling: basic properties of copulas, classification of copulas with examples, measuring dependence, estimation of copulas, applications to portfolio and credit risk.

- Market microstructure and high-frequency data: market microstructure primer, market liquidity risk, volatility estimation and forecasting using high-frequency data, applications to risk measures.

Course tutor: Dr Alex Tse Sing-lam

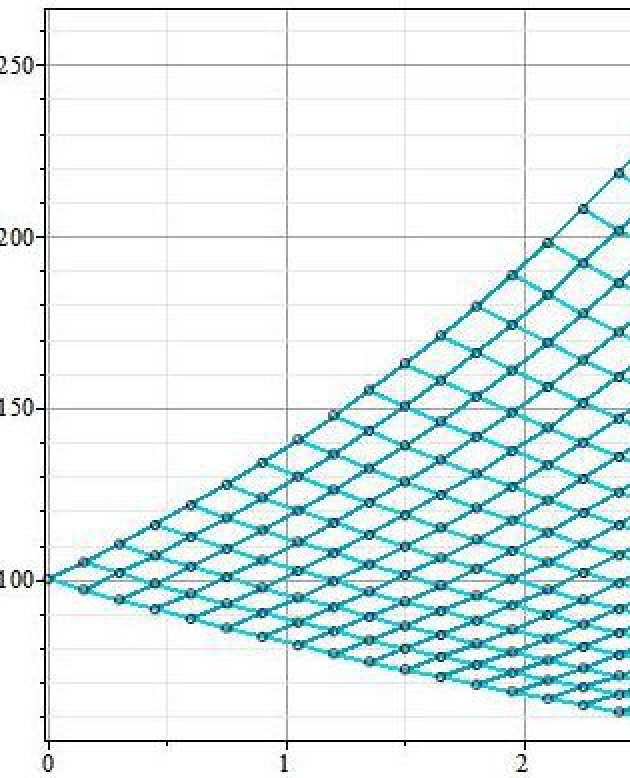

Simulation Methods for Finance (Y. Zhang)

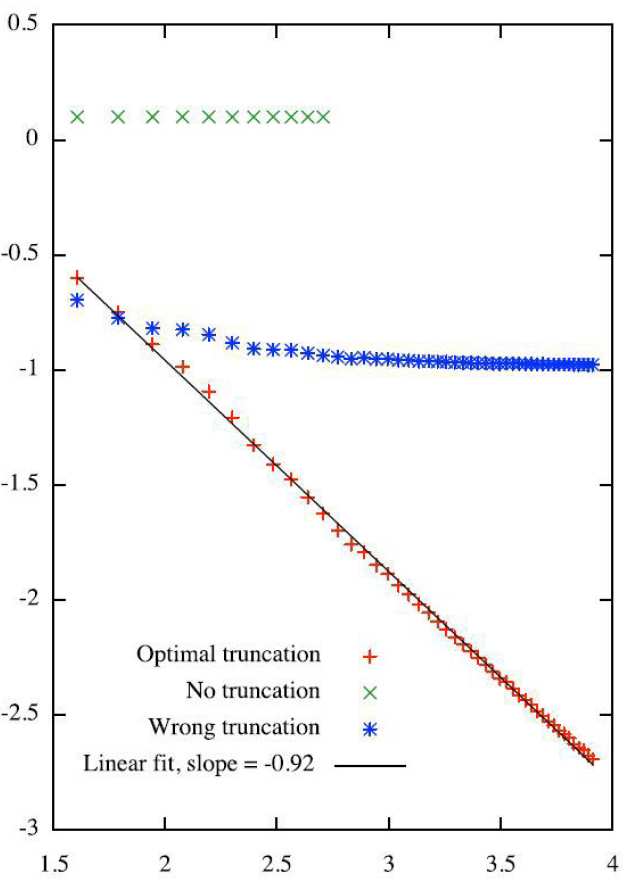

This course is an introduction to simulation methods in finance and more generally to probabilistic numerical methods for PDEs. It starts with discussion of random number generators, statistical tests and moves on to cover numerical schemes for solving Stochastic Differential Equations: the Euler, Milstein and certain higher-order schemes. Properties of weak and strong convergence, consistency and numerical stability are established. It then discusses variance reduction techniques and estimation of sensitivities. The course will be concluded by studying a numerical method for American Options and non-linear PDEs, if time permits.

This course is an introduction to simulation methods in finance and more generally to probabilistic numerical methods for PDEs. It starts with discussion of random number generators, statistical tests and moves on to cover numerical schemes for solving Stochastic Differential Equations: the Euler, Milstein and certain higher-order schemes. Properties of weak and strong convergence, consistency and numerical stability are established. It then discusses variance reduction techniques and estimation of sensitivities. The course will be concluded by studying a numerical method for American Options and non-linear PDEs, if time permits.

- Course tutor: Professor Harry Zheng

Statistical Methods in Finance (C. Salvi)

The financial industry has changed dramatically over the past few years, and the new regulations imposed to banks require more statistical knowledge. The aim of this new core module is to reflect these changes, and to make students up to date with the current needs of the financial sector. This course is concerned with essential statistical methods for the analysis of financial data. Topics covered include regression methods (including ordinary and generalised least squares), time series analysis (including ARMA, ARCH, GARCH), Bayesian analysis, parametric estimation methods (including maximum likelihood estimation and classical asymptotic theory), and non-parametric estimation methods. The various methods are illustrated by applications in finance and tests on real data.

The financial industry has changed dramatically over the past few years, and the new regulations imposed to banks require more statistical knowledge. The aim of this new core module is to reflect these changes, and to make students up to date with the current needs of the financial sector. This course is concerned with essential statistical methods for the analysis of financial data. Topics covered include regression methods (including ordinary and generalised least squares), time series analysis (including ARMA, ARCH, GARCH), Bayesian analysis, parametric estimation methods (including maximum likelihood estimation and classical asymptotic theory), and non-parametric estimation methods. The various methods are illustrated by applications in finance and tests on real data.

- Course tutors: Dr Thomas Cass

Stochastic Processes (E. Neuman)

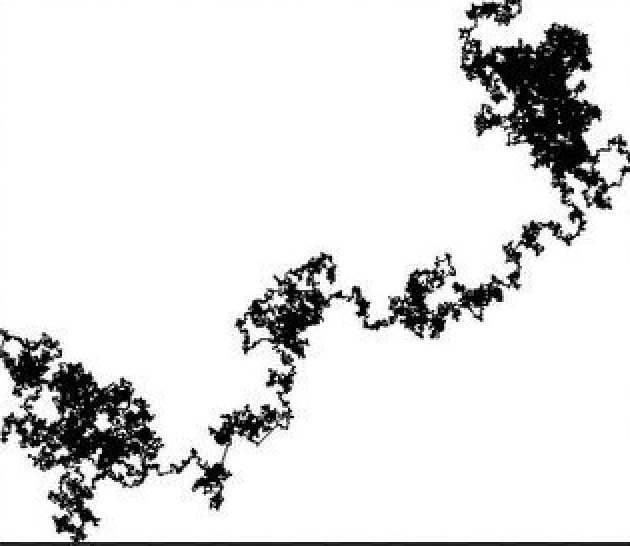

This course gives an introduction to probability theory and measure theory and introduces stochastic processes and the basic tools from stochastic analysis to provide the mathematical foundations for option pricing theory. It includes an intermediate introduction to axiomatic probability theory and measure theory, explaining notions like probability spaces, measures, measurable functions, integration with respect to measures, convergence concepts for random variables, joint distributions, independence and conditional expectations. It studies stochastic processes in discrete and continuous time; mainly the random walk, Brownian motion, and their properties. These in turn involve notions like the quadratic variation, the reflection principle, the Markov property and the martingale property. We will cover the stochastic Ito integral, the Ito formula, and their mathematical applications; for example, stochastic differential equations and some references to partial differential equations.

This course gives an introduction to probability theory and measure theory and introduces stochastic processes and the basic tools from stochastic analysis to provide the mathematical foundations for option pricing theory. It includes an intermediate introduction to axiomatic probability theory and measure theory, explaining notions like probability spaces, measures, measurable functions, integration with respect to measures, convergence concepts for random variables, joint distributions, independence and conditional expectations. It studies stochastic processes in discrete and continuous time; mainly the random walk, Brownian motion, and their properties. These in turn involve notions like the quadratic variation, the reflection principle, the Markov property and the martingale property. We will cover the stochastic Ito integral, the Ito formula, and their mathematical applications; for example, stochastic differential equations and some references to partial differential equations.

- Course tutor: Dr Eyal Neuman