Building better models for understanding and regulating financial instability

by Jenn Rowater

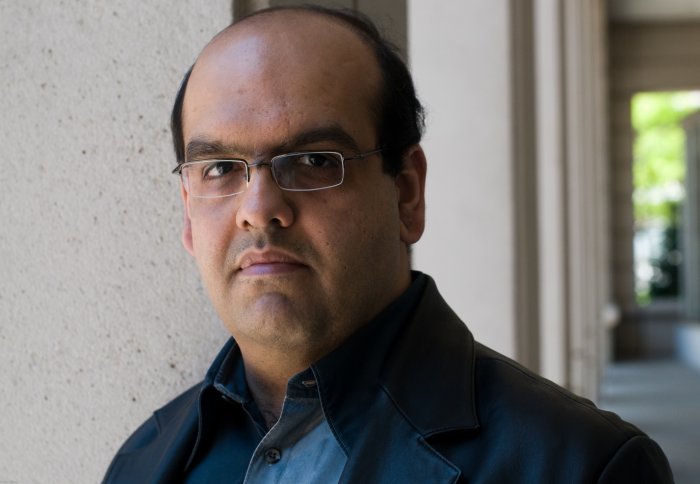

Professor Rama Cont collaborates with financial regulators to understand why financial models fail and design better risk management systems

Market instability can have costly consequences for society as a whole, and researchers at Imperial College London are exploring how mathematical modeling can help design systems that will improve the monitoring and management of risk. Professor Rama Cont and the Mathematical Finance group he leads within the College’s Department of Mathematics are collaborating with financial institutions and regulators to understand the mechanisms underlying large-scale market instabilities – and design better systems for the monitoring and regulation of systemic risk in the financial system.

“We are interested in situations in which quantitative risk management models fail to function properly, and designing novel modeling approaches for addressing these failures” says Professor Cont. “Our group, the largest of its kind in the world, leverages the high level of mathematical expertise in the Department of Mathematics to design better approaches for modelling, measuring and monitoring financial risk, with a focus on the large-scale risk management problems.”

To translate his work from theory to practice, Professor Cont collaborates with researchers at the Bank of England, the European Central Bank and the US Federal Reserve, as well as financial exchanges in Chicago, New York, Oslo, Hong Kong and Sao Paulo.

“One third of my time is spent discussing with regulators about the problems they are facing” says Professor Cont. “Their policy concerns guide our research. We design mathematical models which can help policymakers and financial institutions see how their decisions may affect market stability.”

In a recent project, Professor Cont and collaborators helped design a new integrated system for managing liquidity risk and market risk that was implemented last year at BMF Bovespa, the Brazilian stock exchange.

“It brings great satisfaction to see our research ideas implemented in a practical setting,” says Professor Cont. “Following the implementation of the system in Brazil, we have been solicited by regulators and financial institutions interested in adopting this approach. This is an example of the impact of mathematics research on policy and market practice.”

If you would like to offer support or discuss the role you could play in helping the College achieve its goals, please contact PatrickStewart on 020 7594 2667 or Seema Jagdev on 020 7594 5313.

Article text (excluding photos or graphics) © Imperial College London.

Photos and graphics subject to third party copyright used with permission or © Imperial College London.

Reporter

Jenn Rowater

Advancement