Don’t wait for a unicorn: investing in low-carbon tech now will save money

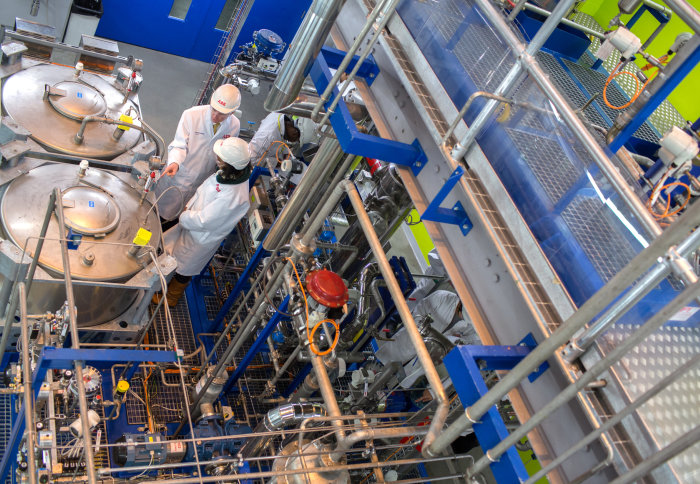

Imperial's carbon capture and storage pilot plant

Waiting for a ‘unicorn technology’ that provides green energy at low cost could be more expensive than adopting low-carbon energy technologies now.

Researchers from Imperial College London say if Britain invested more in today’s low-carbon energy technologies, it would save more money in the long term than waiting for a mythical future technology that may never materialise.

In a study published today in Nature Energy they say using existing technologies now – even if they are imperfect – could save 61 percent of future costs.

We find that such myopic planning and investment delays lead to poor power systems planning. Clara Heuberger

Renewable energy technologies, such as solar panels and wind farms, are growing in use. They are a key part of plans to meet climate targets by 2050 and have so far benefited from substantial backing to aid their deployment.

However, energy produced using other low-carbon technologies currently cost more to produce than traditional fossil fuels sources. These include carbon capture and storage (CCS), which removes carbon dioxide from fossil fuel power plant emissions. As a result, those planning new power systems often cite the cost of these technologies as a reason against greater adoption and investment in them.

'Go' or 'wait'?

Researchers fear that when planning for the future some decision-makers prefer to wait for a “unicorn technology” that generates electricity at zero carbon emissions, low cost and high flexibility, rather than invest in imperfect current technologies.

To find out the impact of this strategy, researchers from the Centre for Environmental Policy and the Department of Chemical Engineering at Imperial modelled a range of future scenarios between two extremes. The so-called ‘go’ option would see extensive investments in currently viable renewable technologies now. The ‘wait’ option advocates holding out for cheaper, more advanced low carbon energy technologies down the line.

The team modelled the expansion of Britain’s electrical grid under these scenarios, including government investment in technologies such as carbon sequestration and nuclear power now, to the appearance of a breakthrough unicorn technology and its immediate uptake.

Myopic planning

They found that whether the “unicorn” materialises or not, delaying investment in today’s technologies can have high implications on cost and emissions. For example, waiting for technology that never materializes would increase costs by 61% over deploying existing technologies now.

Even if a “unicorn” technology did appear, waiting would still increase costs, because a lot of fossil fuel infrastructure would still be built, but not used. For example, new natural gas plants and pipelines could be built that would simply not be used when the new technology emerged, meaning the cost of building them was wasted.

Lead-author of the research Clara Heuberger, form the Centre for Environmental Policy, said: “We find that such myopic planning and investment delays lead to poor power systems planning. In particular, such scenarios result in either grossly oversized and underutilised power systems or ones which are far from being decarbonised by 2050.”

-

'Impact of myopic decision-making and disruptive events in power systems planning' by Clara F. Heuberger, Iain Staffell, Nilay Shah and Niall Mac Dowell is published in Nature Energy.

Article text (excluding photos or graphics) © Imperial College London.

Photos and graphics subject to third party copyright used with permission or © Imperial College London.

Reporter

Hayley Dunning

Communications Division