Written by

Published

Category

Key topics

Financial services firms expect significant growth in their use of machine learning, but are already having problems implementing it at scale

Executives responsible for technology strategy are receiving mixed messages about artificial intelligence (AI) and machine learning.

A Bank of England survey found that financial services firms expect significant growth in the use of machine learning over the next three years. Firms are investing in machine learning to automate decision making; they hope to save time and cut costs, reduce the potential for human error and potentially produce new insights from company data that can be exploited for commercial advantage.

But such optimism contrasts with reports that firms are facing significant challenges trying to implement machine learning models at scale. Gartner captured this sentiment with the dramatic prediction that “through 2022, 85 per cent of AI projects will deliver erroneous outcomes due to bias in data, algorithms or the teams responsible for managing them”.

The key to making good decisions about AI and machine learning – and avoiding expensive failures – is to understand the current state of the technology, where it works well, and where it doesn’t.

Here are five fundamentals executives should know about AI and machine learning:

1. AI and machine learning are different

It is important to understand the difference between AI and machine learning to help differentiate between marketing puff and real use cases.

AI is concerned with creating computer systems that can mimic, perhaps even improve on, the way humans think. Though the term has become ubiquitous, "AI” remains a long-term vision rather than something that is here today.

Machine learning is a subcategory of AI and describes algorithms that have been designed with a particular goal in mind: to fit models or recognise patterns from data without being explicitly programmed and with limited or no human intervention.

Machine learning is an important incremental step toward artificial intelligence, it is already here, and it has many applications: it is, for example, used by search engines to rank results.

2. How to train your algorithm

Machine learning algorithms have been applied very effectively to play games without human input: you may have read about Google’s AlphaGo, a system that beat the world’s top human player at the game Go. The important thing to realise is that a game like Go, although very complex, has clear rules and a clear end goal. Machine learning excels at detecting patterns in data and works very well when applied to logical systems like games where the algorithm can systematically work through a range of actions until it lands on the action that results in the greatest reward.

A recent study by Imperial researchers in Nature demonstrated how machine learning algorithms can be very effective decision support tools when trained to identify the right answer. The study showed they were able to correctly identify breast cancers from scan images with a similar degree of accuracy to expert radiologists.

"AI” remains a long-term vision rather than something that is here today

In a finance context, machine learning algorithms have helped firms make sense of noisy and complex data sets. For example, they have been employed successfully to help analysts distil hundreds of potential indicators of future investment returns to a few, more robust, measures.

Machine learning may therefore work well and support decision making if you know what you are looking for, where to look for it, and why you are looking for it, but the task is currently very hard for a human (e.g. because there is too much data, the task is repetitive, there are too many potential scenarios for a human to compute, or the data is noisy so it is hard to distinguish significant patterns from anomalous ones).

3. Machines aren’t (yet) a substitute for human reasoning

It is currently much more challenging to use machine learning to support automated decision making in uncertain environments. While algorithms excel at identifying relationships and patterns, they cannot evaluate whether such correlations are legitimate. So it can be dangerous to use machine learning algorithms to solve problems where there is no obvious “right” answer or doubts over causation.

This challenge comes to the fore in finance when we try to establish deep economic associations from data and answer questions such as: “At what point do highly leveraged companies stop investing?” or “How will a rise in interest rates impact economic growth?”

We could develop an algorithm to identify patterns in historic data sets to answer these questions and it may well spot interesting relationships for further analysis. However, it would be dangerous to rely on such algorithms as a basis for decision making. A machine-learning algorithm would only spot patterns and would not give enough indication of the underlying economic mechanisms that caused them.

4. Good algorithms start with good data

Machine learning can create unreliable results if applied to small data sets or data sets that are biased. Many of the finance practitioners I speak to have trouble generating enough data of the right quality. It is a misconception that all areas of the finance industry are awash with data. This is true in transactional areas such as payments, but, in contrast, it is very hard for an analyst who typically works from company quarterly reports to collate enough data to build a statistically robust machine-learning model. Likewise, it is difficult to construct robust investment portfolios when using monthly data.

We also struggle to produce algorithms that do not create implicit biases in contexts where privacy and fairness are important. My colleague Tarun Ramadorai has written an interesting piece about machine learning unfairness in mortgage lending decisions.

5. Machine learning can be applied to more than just numbers

Despite the challenges, I believe there are opportunities to use machine learning to improve financial decision making.

Advances in textual analysis mean there are growing opportunities to apply machine learning to data sets that combine text and numbers. I am working on a project that is analysing millions of words of analysts’ reports to compare what analysts say to various audiences with what the numbers objectively tell us. Academics often tend to equate the two types of data as effectively delivering similar information and assume that people respond to them in the same way, but this may not be true in the real world.

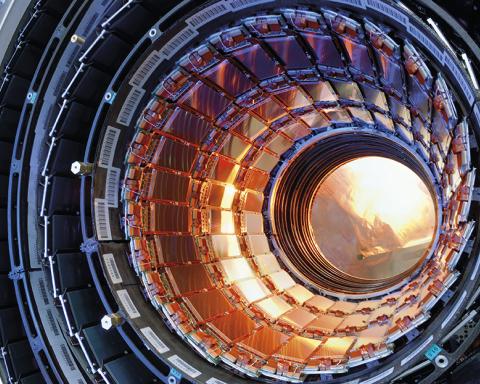

Algorithms are also increasingly being applied to analyse images. Such applications in the finance sector could create more timely and reliable data for analysts. We could, for example, foresee an analyst using real-time satellite imagery of the number of cranes being put up across a city to measure levels of construction activity – producing information in advance of industry surveys. Similarly, we could analyse the intensity of lighting over urban areas to predict economic growth in areas of the world with weak financial reporting standards.

Using machine learning for competitive advantage

We are moving from a period of hype and excitement about the potential of machine learning to a period of reflection and realism where implementation challenges such as ethical and regulatory considerations will come to the fore. If we think about the potential use of “robo advisors” in finance, for example, there is an interesting discussion to be had around whether an algorithm can truly be objective and how such products should be presented to consumers and supervised. There are also exciting, but also ethically challenging, opportunities to use data from other sectors such as climate or health data in financial decision making.

I believe the firms that gain a competitive advantage through their use of machine learning in the next few years will do so because they have access to novel data sets. After all, the leadership of companies such as Amazon and Google in machine learning is built on their access to massive proprietary data sets.

For executives making technology investment decisions, it will be of increasing importance to understand what machine learning and other AI technologies can do right now, and what uses are still a long way from being implementable. Above all, to succeed at machine learning, companies must frame the right questions and have access to the right data.