Published

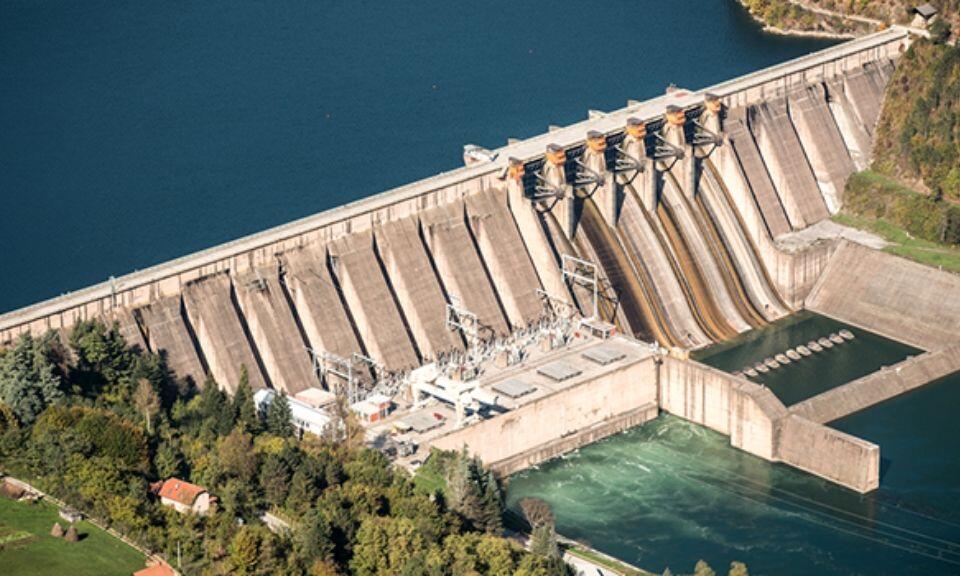

Hydropower is becoming a prevalent source of electricity, accounting for 70% of renewable energy production and providing for 16.6% of global electricity demand. Unlike traditional energy sources such as nuclear and coal power plants, the provision of hydroelectric energy can be ramped up and down very quickly to adapt to changing market conditions.

For a long time, hydropower plants could be operated in a profitable manner by exploiting a “peak/off-peak spread” present on the electricity markets: By purchasing low-cost energy at night to pump water uphill and by releasing the same water during the lunch and evening peaks, hydropower plant owners could generate profits at a low risk. In recent years, however, the advent of alternative sources of renewable energy such as solar PV has decreased the peak prices during the day, while the nuclear moratorium in Germany has led to increasing electricity prices at night. Taken together, both effects have eroded the peak/off-peak spread and thus forced hydropower plant owners to look into new business models.

A particularly promising model relates to the electricity reserve markets, where energy options are traded that give the system operators the right, but not the obligation, to purchase energy at a pre-determined price, to be delivered at a later date. These options allow the system operators to flexibly adapt to short-term market imbalances caused by unanticipated demand fluctuations, plant and line failures and—of particular importance nowadays—unanticipated supply fluctuations (e.g. due to the presence of solar PV or wind farms). The flexibility of hydropower implies that hydropower plants are well suited for writing such options.

Whilst these options constitute a crucial risk management tool for system operators, the pricing of these options poses serious theoretical and numerical challenges. In particular, classical results from financial options theory, such as the celebrated Black-Scholar model, are not applicable due to the presence of line and plant failures, which lead to price jumps, as well as the fact that energy is not traded in continuous time. Together with partners from industry, researchers at Imperial Business Analytics with KPMG are investigating how state-of-the-art optimisation techniques can assist hydropower plant owners to optimally act on the energy reserve markets.