The Fund’s Quantitative Branch focuses on leveraging systematic tools to create investment strategies.

This year is an amazing opportunity for us both to manage the Quantitative branch of the Student Investment Fund. Currently our Momentum strategy is live and being actively traded. This year we aim to take 2 more strategies live. We also aim to run a series of Speaker Sessions from industry leaders, and provide employment opportunities to the Quantitative members of the fund!

Statement from the CIO’s, Harvey Sturgess and Baptiste Loyer.

This year’s Quantitative Team is split based on the 6 quantitative strategies: Momentum, Machine Learning, Statistical Arbitrage, Alternative Risk Premia, Macro Sentiment and Risk. Each team has a Senior Analyst overseeing 5-7 Junior Analysts as they work on research, implementation, and back-testing of these strategies.

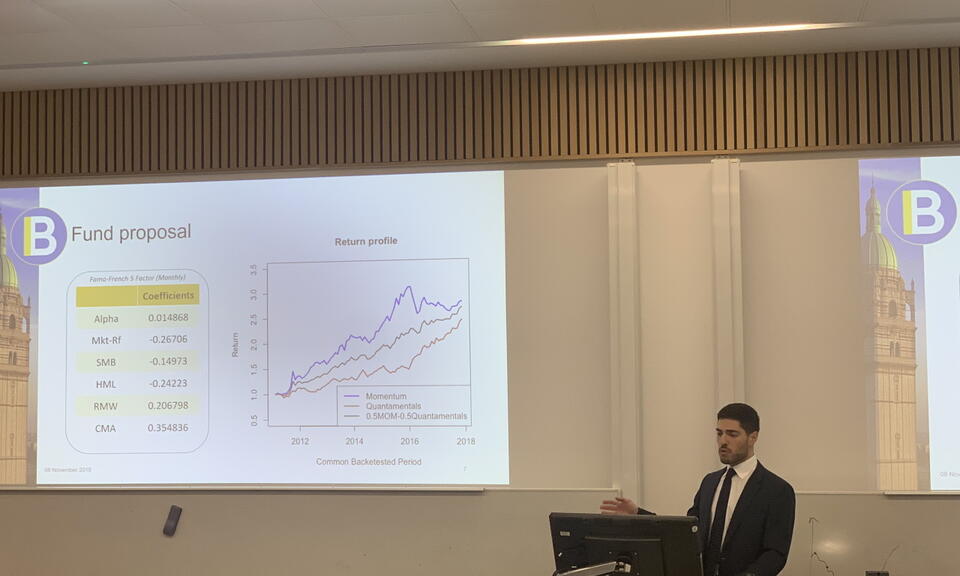

The quantitative department’s momentum strategy is live and being actively traded. It is a volatility-scaled cross-sectional momentum on US equity sectors ETFs, with a value and hedge component. We hope to update you soon when other strategies become live!