Think blockchain is something to do with cryptocurrencies and nothing to do with you? Think again.

Words: Jessica Twentyman / Illustration: Stephen Cheetham

How it really works

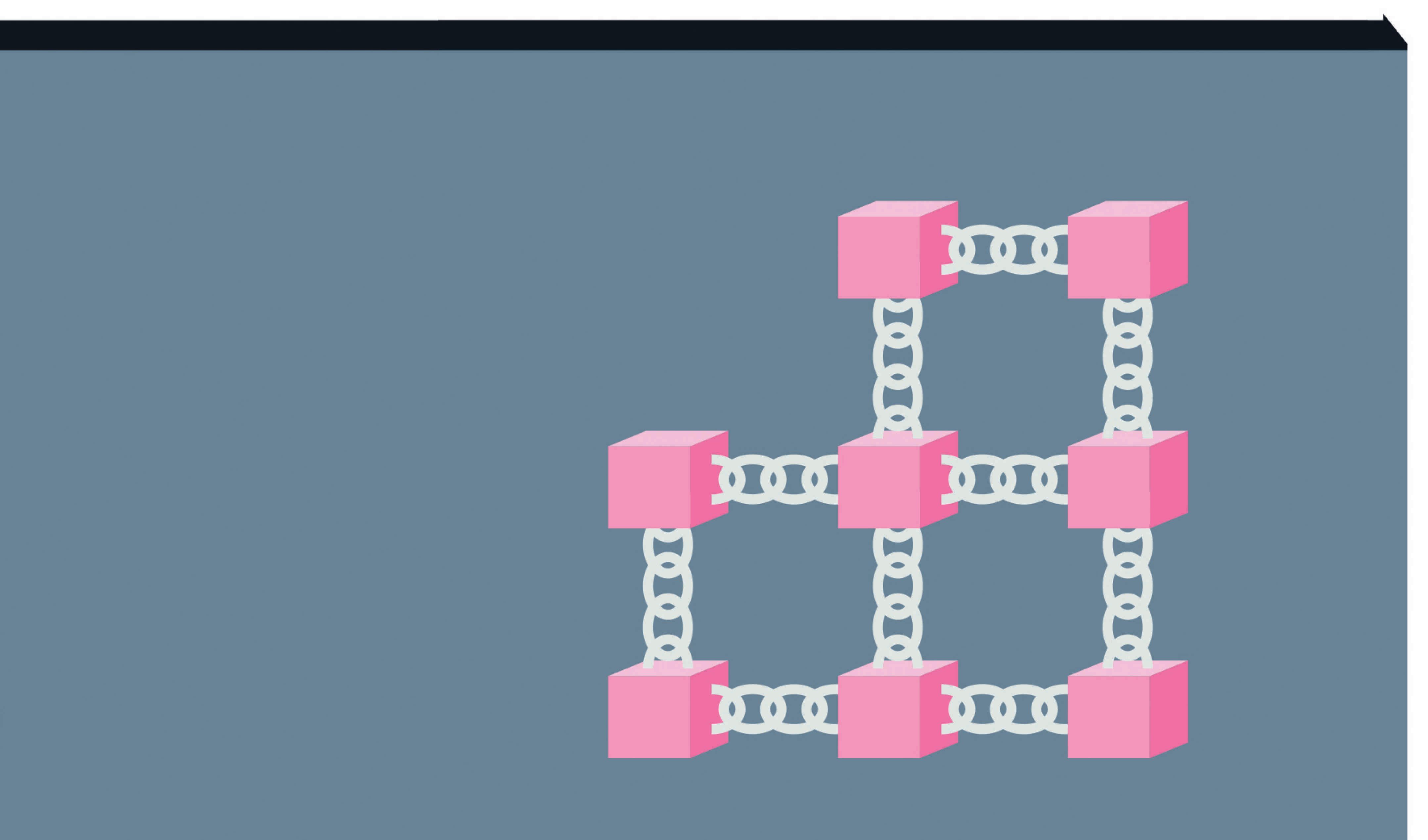

Removing the need for a trusted third party for oversight and governance, a blockchain relies on a decentralised database (or ‘digital ledger’) of direct transactions that everyone in that network can see and approve. It comprises a shared network of replicated databases, synchronised via the internet. Professor William Knottenbelt, Director of the Centre for Cryptocurrency Research and Engineering, explains the process.

1. The deal

A deal is agreed between two users and its details are entered on a ledger using a simplified interface. Transactions can involve cryptocurrency (such as Bitcoin for example) but also contracts, records or other agreements involving two or more parties.

2. The details

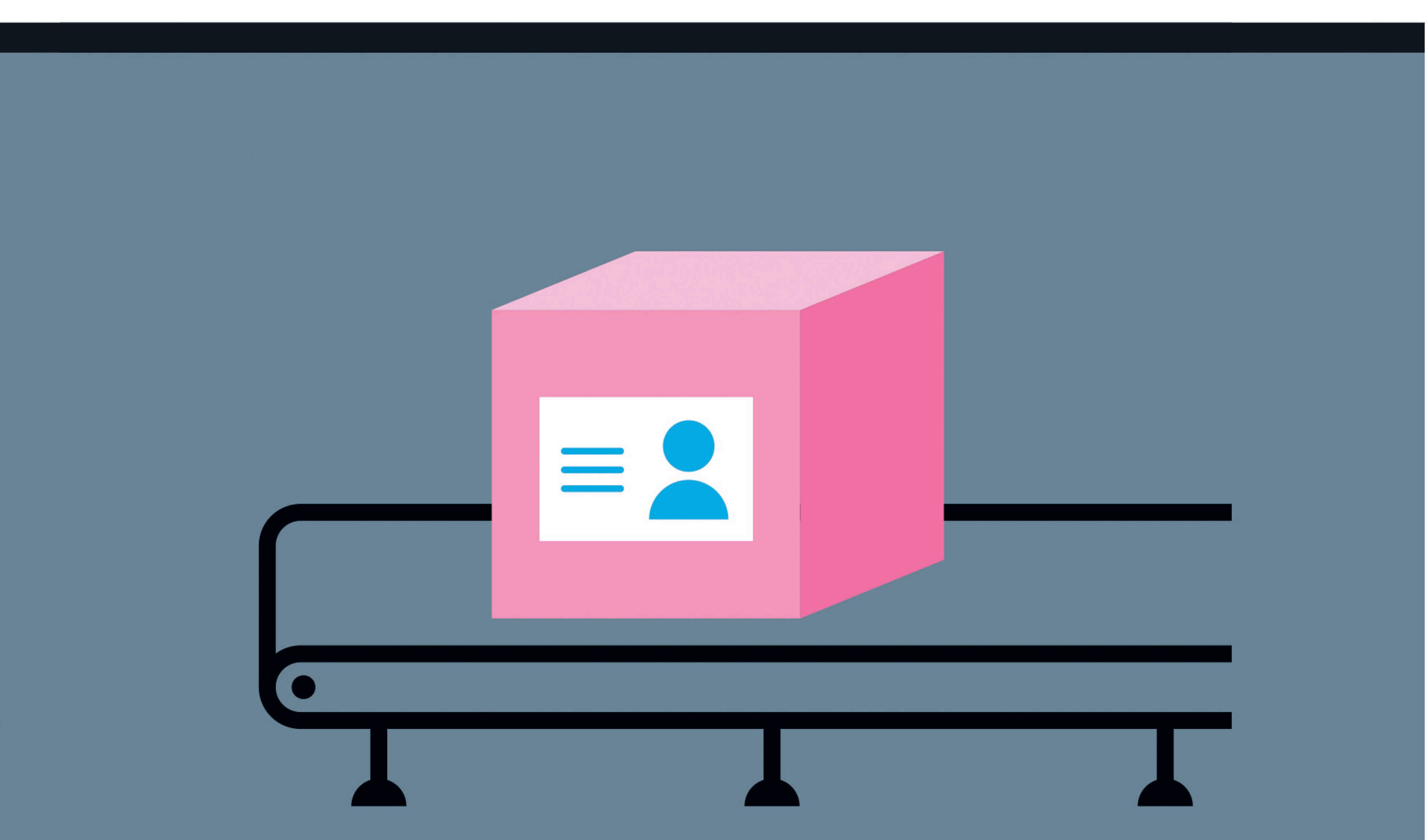

Details of the transaction are captured in a ‘block’ of data, typically containing information about the sender, the receiver, a date/time stamp and details of the asset type and quantity. Each block has a unique identifying number and ‘hash’, a reference to the previous block in the chain.

3. The approval

At frequent intervals, a cryptographically protected group of proposed transactions is shared peer-to-peer across the network of participants. In order to be added to the blockchain, each block must contain the answer to a mathematical problem created using the cryptographic hash data.

4. The validation

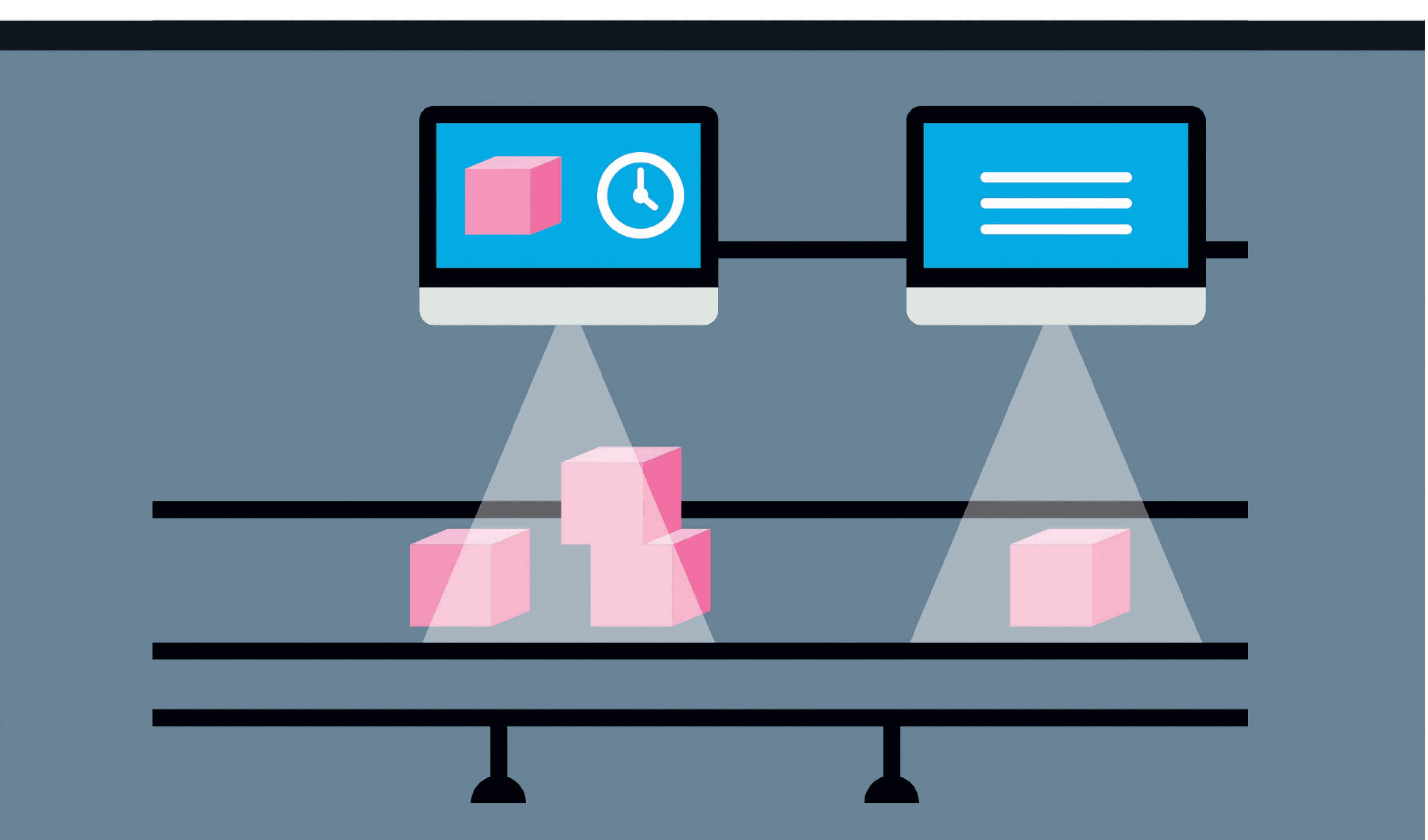

Participating computers in the network are incentivised to automatically check the blocks, to confirm that they follow the rules. Once satisfied, they validate them and apply the included transactions to their own ledgers.

5. The chain

The validated transaction is added to the continually updated chain in a linear, chronological order and is considered ‘complete’, with every participant in the network having the ability to prove who owns what.

It’s an act of reinvention that would impress even the most avid social climber. Blockchain is kicking off the traces of its somewhat shady past and now, in 2017, the former enfant terrible of finance is wearing the mantle of respectability.

Today, giants including Microsoft, IBM, HP and Intel are all backing the technology. And big banks are in thrall to the promise of what it could do for them, with Credit Suisse, J.P. Morgan, Royal Bank of Scotland, UBS and BNP Paribas, among others, all signed up to a consortium that aims to explore the technology’s potential for banking, led by start-up company R3.

Which is all a far cry from blockchain’s beginnings as the underpinning mechanism for cryptocurrency bitcoin. Launched in 2008, this alternative currency was an anti-establishment, post-financial crisis initiative that aimed to play the global banking system at its own game.

Efforts to uncover the real identity of its creator, Satoshi Nakamoto (assumed to be a pseudonym), have come to nought. What is clearer, however, is that bitcoin has been used by a rogues’ gallery of money launderers, Ponzi-scheme fraudsters and illegal drug-dealing sites on the ‘dark web’, albeit alongside more legitimate customers. But as Professor Andrei Kirilenko puts it: “The interesting part of bitcoin isn’t bitcoin. Not any more. It’s the blockchain technology that underpins it.”

Kirilenko, the Director of the Centre for Global Finance and Technology at Imperial College Business School, points to blockchain’s superiority at enabling individuals to engage in transactions without relying on traditional gatekeepers such as governments, exchanges or financial institutions. The fact that the technology provides a way to create tamper-proof ledgers of transactions could, he says, ultimately transform the way that many organisations – such as banks, law firms and public-sector agencies – keep records, because blockchain provides a robust and more cost-effective alternative to traditional clearing and settlement mechanisms.

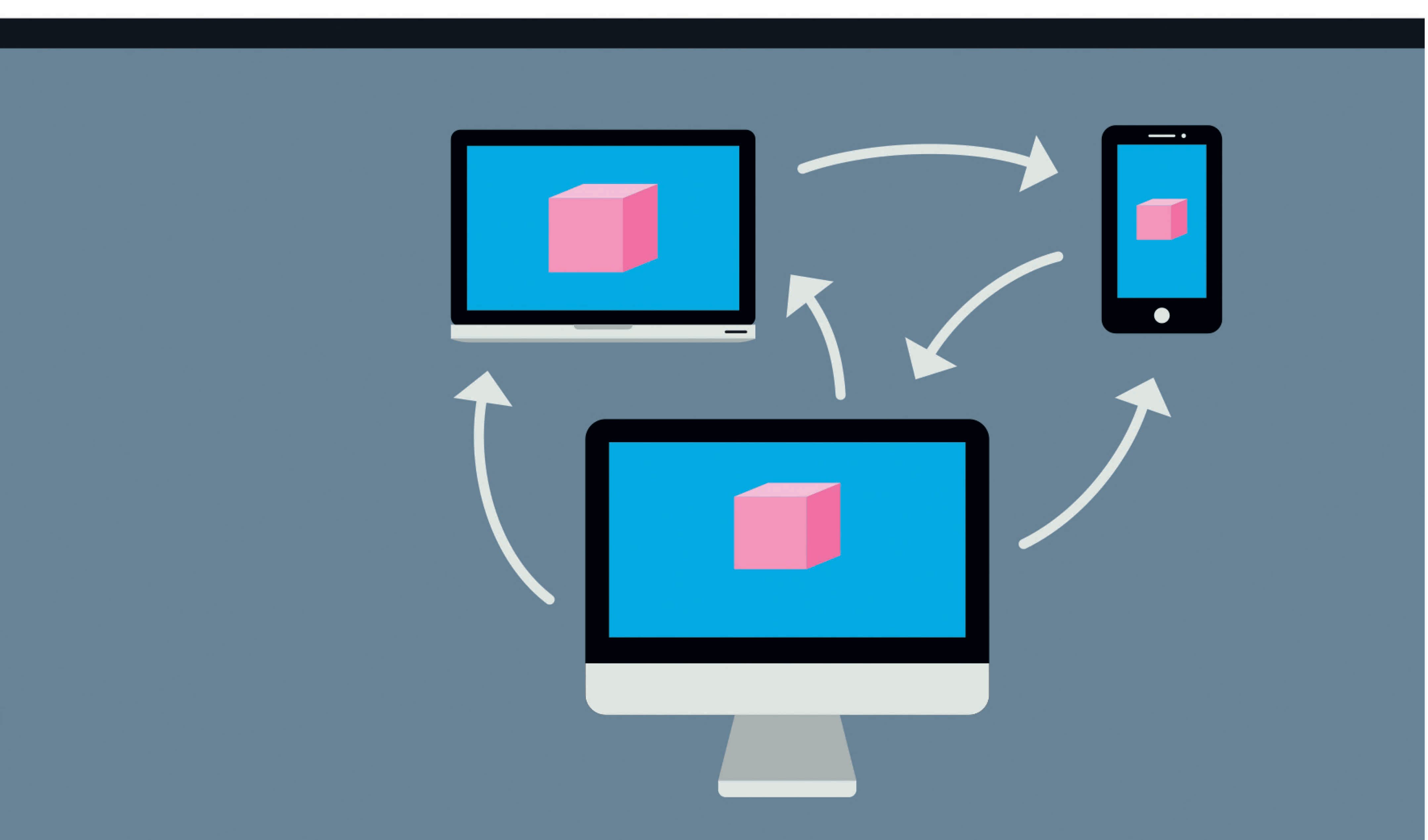

It’s the distributed nature of blockchain, however, that has got so many people excited. When a blockchain transaction takes place, it is processed and authenticated across a potentially vast network of separate computers, without the use of a central server. In this way, the distributed ledger of transactions continually grows and is shared in real time with users, but once it is added, a transaction record is permanent and cannot be changed – it’s ‘immutable’ in blockchain-speak – because altering it would require access to millions of separate computers.

“In other words, no one person or group holds the entire ledger of transactions, nor can they falsify a transaction, because every member of the network helps to validate and run the database,” explains Kirilenko, “It’s a complete, immutable and, at the same time, freely observable record of transactions that protects the identity of participants while preventing them from cheating each other or the system.”

This brings us to the tricky issue of scalability: a blockchain requires an amount of computer space commensurate with its length (that is, the number of blocks it contains). In a public blockchain, where thousands of ‘nodes’ (the computers owned by participants) store copies of blockchain content, some believe this could ultimately limit the volume of transactions the network is able to handle, although this is largely unproven at this early stage in the technology’s development. In a private blockchain, which is open to only a handful of pre-approved participants (the model most often explored by banks for interbank trading, for example), participants could reasonably be required to dedicate greater quantities of processing and storage resource to the network, thus boosting scalability.

Beyond financial services

All this makes this distributed ledger technology suitable in all manner of applications, explains Dr Catherine Mulligan, research fellow and co-director at the Imperial College Centre for Cryptocurrency Research and Engineering (IC3RE).

While much mainstream attention is focused on how financial services companies will use blockchain, she says, the technology’s ability to deliver complete transparency and auditability could have a big impact elsewhere. She’s lead investigator on CREDIT (Cryptocurrency Effects in Digital Transformations), a project at IC3RE funded by the Engineering and Physical Sciences Research Council, which aims to investigate and understand the potential of blockchain to create decentralised records of transactions in sectors such as energy, insurance and healthcare. And last year she contributed to a report for the UK government, exploring how it might revolutionise both public and private sector services.

“The reason that blockchain is so fascinating to me is that I see it as the world’s first digital economy, allowing the exchange of value between individuals in ways that could help us combat some huge global challenges,” she says.

Take, for example, the traceability of food in global supply chains – an issue that was highlighted by the 2013 horsemeat scandal, casting a worrying light on the dubious provenance of frozen beefburgers and ready meals. It’s hard to build a clear picture of events in supply chains that span many stages of production and geographical incidents, so supermarkets and shoppers have no reliable way of knowing that the lasagne they’re buying, for example, contains the ingredients listed on the label. Here, Mulligan believes that blockchain could help. If every producer and manufacturer involved in the creation of a foodstuff used blockchain to register the transfer of goods it would clearly identify each party in the supply chain and provide further information on the date, location, quality and processing of ingredients.

According to Professor William Knottenbelt, Director of the Centre for Cryptocurrency Research and Engineering, The Gemological Institute of America (GIA) hack in 2015 represents a perfect of example of how a blockchain – with its key characteristic of immutability – could work much better for some applications than a standard database. The GIA revealed that a database used to store grading reports into the cut, clarity, colour and carat of specific precious gemstones had been accessed and changed without authorisation by former employees of its database support contractor. The GIA was subsequently forced to invalidate 1,042 of these reports.

“Normal databases don’t come with mechanisms to ensure the integrity of records,” says Knottenbelt. “If you’ve got permission to access the database, you can modify the records it contains. In a blockchain environment, it would be impossible to change those records and edit the characteristics of a diamond without others knowing about it.”

Disruption ahead

From an economic perspective, however, Kirilenko predicts enormous disruption ahead. “While there’s certainly plenty of activity and experimentation going on, there are very few people looking into how blockchain will change the fundamentals that financial economists really care about: where do buyers and sellers come from, how do prices form, and how do traders handle different types of risk in a transaction?” he says.

In other words, the world needs to better understand the wider implications for market participants of what Kirilenko calls the “incredible technology” that underpins blockchain – the maths, the computer science, the cryptography. Regulators must walk a fine line between taking action that runs the risk of stifling innovation on the one hand and allowing it to subvert established trust mechanisms in an entirely uncontrolled way on the other.

But as he scans the 2017 horizon for new blockchain milestones, Kirilenko says he’ll be looking for the first limited regulatory approval of a blockchain-based service as the starting pistol for a much wider lift-off for the technology and the emergence of many new business models.

In any case, blockchain isn’t all about big business, says Jeremy Pitt, Professor of Intelligent and Self-Organising Systems and deputy head of the Intelligent Systems and Networks Group in the Department of Electrical and Electronic Engineering. He espouses a rather more radical vision, one in which “blockchain provides a way for communities of people to self-govern and to share assets, regardless of their wealth”.

This thinking, he explains, draws on the theories of Nobel Prizewinning political scientist and economist Elinor Ostrom, whose primary focus was the role of group choice and consensus in the use of shared goods and services – for example, the community management of common pasture in Africa and of community irrigation systems in Andalucia, Bali, California and Nepal.

As a technology, Pitt believes, blockchain (or more generally, distributed consensus technologies) could provide a verifiable way to keep track of the conventional agreements and rules that allow such communities to organise themselves and their assets. “Although the idea of a tradeable, traceable digital token was originally intended to represent a unit of an electronic currency, the token could represent an asset of any kind, for instance a vote, a share, an identity, a social contract – or indeed anything to which you want to ascribe a value,” he argues.

By implementing a blockchain to record contracts and conflicts, and then layering it with a software layer that supports active participation of all the stakeholders, Pitt says that such systems could be used to spur collective action, public decision-making and the ‘fair’ sharing of common resources. He asserts that this is one way to sustain local economies and communities that enable a disparate and heterogenous group of individuals to satisfy a congruent set of shared values.

But Knottenbelt is quick to point out the need for a multi-disciplinary approach. “A major point of concern is that with blockchain, you’ve got software developers performing economic experiments, governed by purely technological considerations rather than with reference to panels of economic experts. I’m not convinced they have thought through the consequences of these experiments at all. Yes, you can use blockchain to tackle money supply issues, but that can have serious knock-on effects. This is why, at IC3RE, we’re pursuing a multi-disciplinary approach, bringing together people from different fields and disciplines to have a look at these kinds of applications and how they might be used in constructive ways, taking into account the context, challenges and consequences of different consequences.”

That the technology is here to stay is becoming less of a point of discussion, as the trusted advisers of some of the world’s highestprofile private and public sector organisations continue to jump on the bandwagon. In January 2017, ‘big four’ consultancy and accountancy firm Deloitte announced it was launching a blockchain lab in Dublin’s Silicon Docks district; respected academic institutions have their finest minds trained on the technology; and some supporters claim that blockchain expertise could be the key to London continuing to lead the world in fintech innovation in a post-Brexit era.

The trust mechanisms that blockchain might support, then, are wide-ranging, largely untested – and have the potential for huge socio-economic and socio-political disruption. Which, in a way, was what bitcoin’s inventors intended.